Design a life of financial security and personal freedom.

Sound familiar?

The people we help are normally struggling with some or all of these challenges:

The juggling act: In the thick of it with work and family commitments - financial matters get put on the 'later' list.

Disorganised dollars: Finances are a bit all over the place.

Earning but not progressing: Making good money but your balance sheet doesn't show it.

Overwhelmed by options: Bombarded with financial advice and don't know where to start.

Complex finances: Navigating trusts, investments, properties.

Finance FOMO: Worried you're missing out on financial opportunities.

Next Stage Navigation: Facing a major life event - career shift, selling your business, inheritance, retirement.

Post-Business Uncertainty: Unsure about life after selling your business.

Salus Financial transforms your financial uncertainty into a streamlined, self-assured plan, helping you navigate towards a retirement that's defined by your choices and timing.

Plan ahead to make work a choice, not a necessity.

SUPERANNUATION

OPTIMISE YOUR SUPER

Boost your retirement savings with tax-savvy strategies that make every dollar in your super count.

TAX PLANNING

MINIMISE TAX

Boost your wealth and legally minimise taxes by figuring out the best financial setup for your unique situation.

INHERITANCE

MANAGE AN INHERITANCE

Navigate your inheritance with expert guidance to minimise taxes, maximise benefits, and integrate it seamlessly into your financial plan.

INVESTMENTS

CREATE A PASSIVE INCOME

Grow your assets so they start earning for you to replace your income, maximise returns and minimise risks.

INSURANCE

PROTECT YOUR LIFESTYLE

Sleep easy knowing you and your family are covered, just in case life throws a curveball like an injury or illness.

BUSINESS INVESTMENT PLANNING

STRUCTURE FOR BUSINESS SUCCESS

Learn the best ways to set up your business investments to keep taxes low and keep your assets safe.

ESTATE PLANNING

SAFEGUARD YOUR ESTATE

Ensure your legacy is preserved and passed on precisely as you wish with comprehensive estate planning supported by a team of experts.

RETIREMENT PLANNING

PLAN FOR RETIREMENT

Whether retirement is just around the corner or way off in the distance, let's get a plan in place so you can retire on your way.

DEBT STRUCTURING

MASTER YOUR DEBT

Make smart moves with your debt to systematically reduce your bad debt while using good debt to grow your future funds.

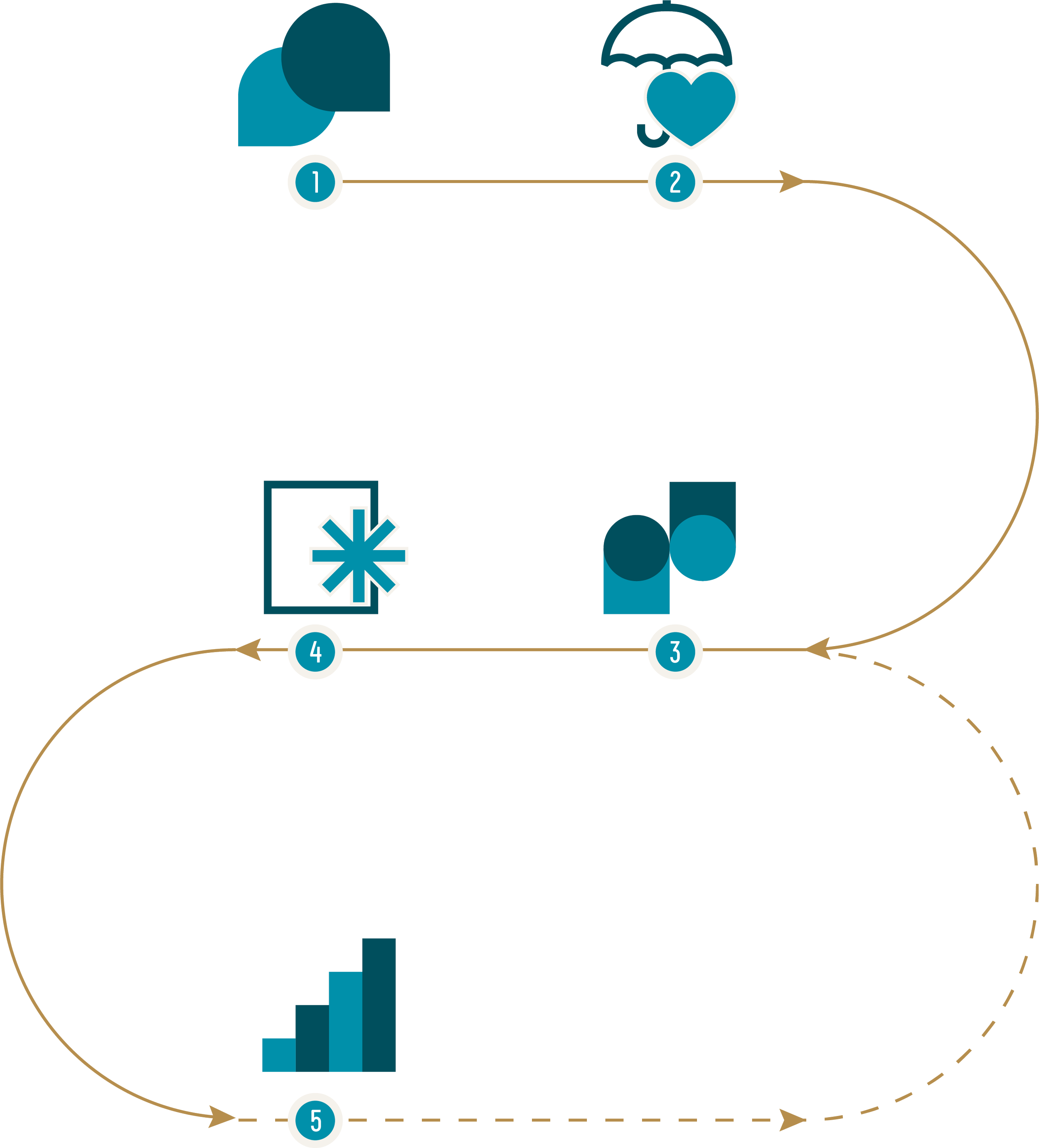

How it works

GOOD FIT CHAT

A no-strings-attached 20 minute phone or virtual chat to see if we are the right fit to work together to help you make your money work for you.

GETTING ACQUAINTED

60-minute in-person or virtual meeting to drill down into what you really want to get out of life and show you what's possible.

PATHWAY AND PLAN

We crunch the numbers, provide you with the systems, structures and steps to get you from where you are today to where you want to be.

MAKING IT HAPPEN

We do all the heavy lifting to implement the recommendations of your financial plan.

TRACKING PROGRESS

We schedule check-ins, either semi-annually or annually based on your unique needs, to fine-tune your plan to keep pace with life's changes - be it legislation, family dynamics, career shifts, or personal goals.

In between catch ups we want you to reach out to us any time you're facing a financial decision that might impact your plan and what matters most to you.